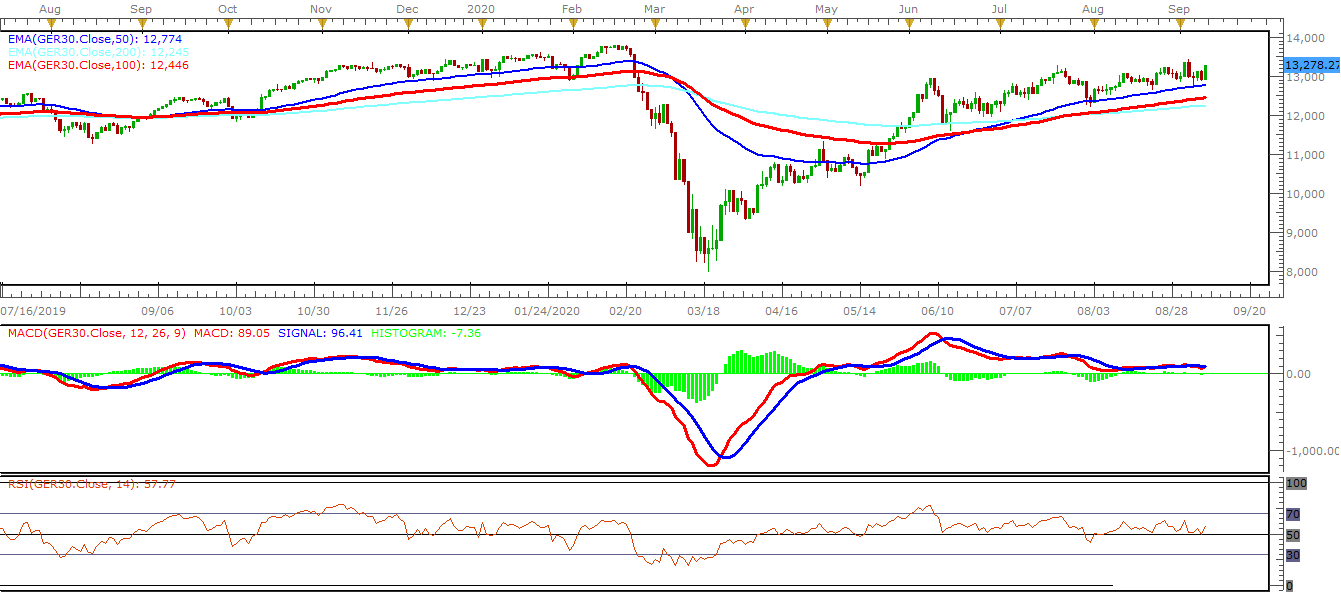

The sideways path in the DAX looks close to ending. The convergence in price over the summer months is setting up for a breakout scenario. Last week, the index attempted to fill the corona-gap, but the attempt was very short-lived as the gap-up into the gap was swatted back lower shortly after the open of trade of that day.

This brought an underside trend-line from June into play, a line that has several inflection points that make it a solid line of support. A break below it would likely lead to a sell-off towards the 200-day and July low at 12253.

But in recent sessions when the U.S. markets have worked off some their froth, Europe has held it together. This did not seem a likely scenario before as relative weakness in the DAX and CAC appeared to be sending a signal that they wanted to trade lower once the leading stock market took a break from rallying.

If the DAX can continue to show short-term relative strength in the face of further U.S. weakness, then this could set up for a sustained breakout into the corona-gap towards new record.